Q2 2024 Real Estate Market Update

Colorado Springs Real Estate Quick Facts

Mortgage rates were relatively flat for the Quarter as well from the same quarter last year (SQLY)

- Average active listings for the quarter were 1820, compared to 1290 from the SQLY (up 41%)

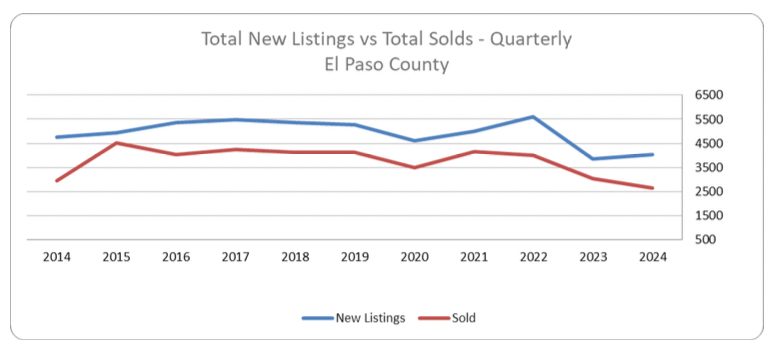

- Total new listings for the quarter were 4036, compared to 3855 from the SQLY (up 4%)

- Sales for the quarter were 2629 units, compared to 3019 from the SQLY (down 13%)

- Average sales price for the Quarter was $572,789 up from $545,116 during the SQLY (up 5%)

- Average median sales price for the Quarter was $503,317 up from $479,333 (up 5%)

- Average days on market for sold homes was 36 for the quarter, up from 28 days from the SQLY

- Single family permits YTD were 1701 compared to 1684 from the SQLY (up 1%)

Market Summary

In the second quarter of 2024, the real estate market began to show signs of weakening. Inventory levels surged by nearly 60%, while prices saw only modest gains. The number of buyers is shrinking, primarily due to higher interest rates. Although rates dipped below 7%, it wasn’t sufficient to bring many buyers back into the market. As the buyer pool decreases, the number of available homes is steadily increasing. Other reasons for the rise in active listings is likely driven by investors offloading properties due to new laws enacted in Colorado and sellers who had previously delayed selling due to their low mortgage rates – finding convenience outweighing financial considerations.

Other key metrics we monitor, such as Days on Market, Inventory, and Sales Price/List Price ratios, remain solid due to highly desirable “cream-puff homes” selling quickly and often above their listing prices. However, we anticipate these figures will shift in the latter half of the year as most homes will stay on the market longer.

Prices are still rising, albeit at a more moderate rate of 1%-5%, a trend we expect to continue through 2024. The Federal Reserve has hinted at potential rate cuts later this year, provided inflation continues to decline. Despite initial hopes that mortgage rates below 7% would attract more buyers, this has not materialized. It appears that rates will need to approach 6.5% to significantly increase buyer activity.