Quarterly Residential Review Q2 2020

Welcome to the ERA Shields Quarterly Residential Review or Stat Pack. The intent for providing information to you is to educate you on the current local real estate market so you can better make decisions for you and your family. Real estate markets vary from city to city as well as neighborhood to neighborhood. When the national media reports how the real estate market is doing, it is reporting on national numbers and it is likely very different from how your neighborhood is performing. You will find factual data within this document from which you may draw your own conclusions. We include a brief summary on the last page.

QUICK FACTS

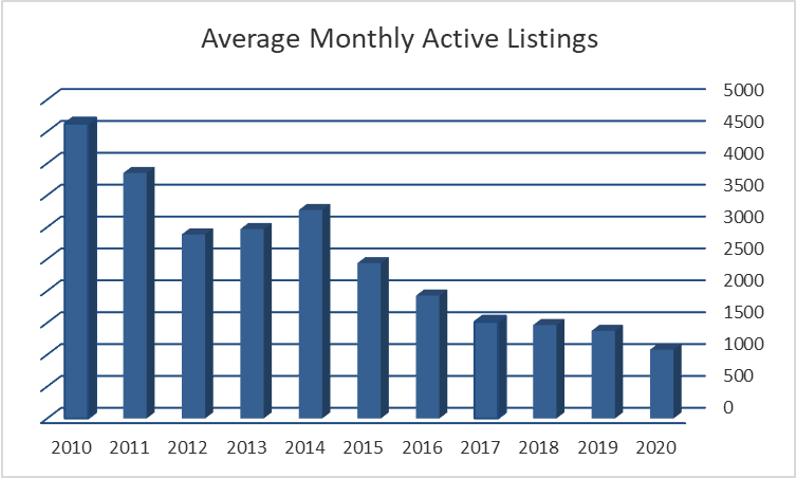

- # of Active Listings for the Quarter were down 885 units <21%>

- # of Sales for the Quarter were down 244 units compared to last year <6.5%>

- Single Family Building Permits jumped 251 units (24%) for the Quarter

- Median Price for the Quarter is up to $353,300 (8.1%)

- Average Price for the Quarter went up to $398,510 (7.2%)

- Just 22% of sales in the Quarter were under $300K

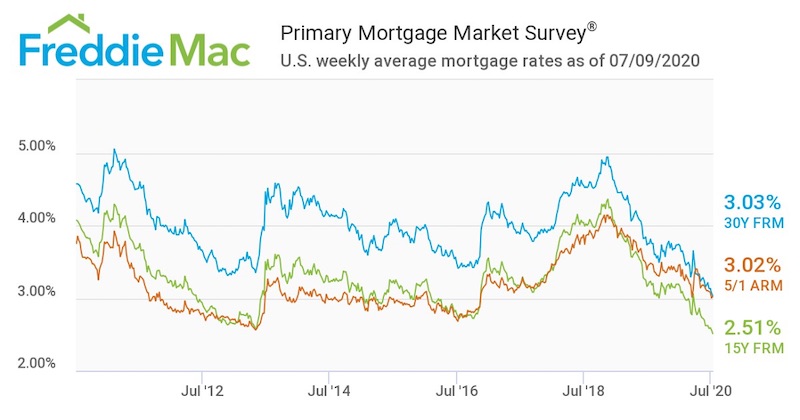

- Mortgage Rates are at an all-time low again, 3.03% on July 9th

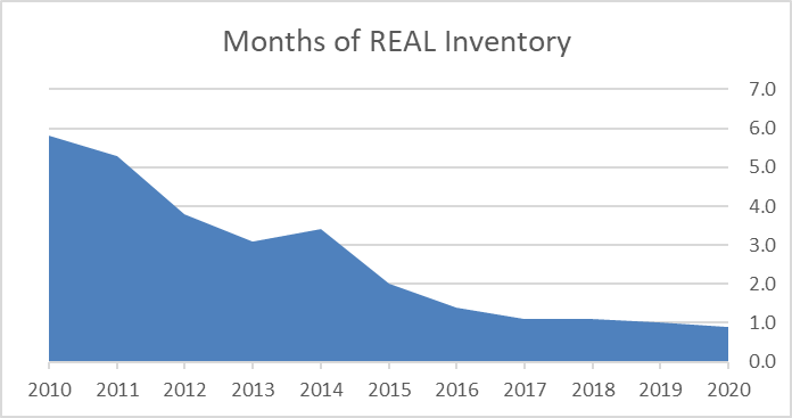

This graph compares the number of homes on the market (Active & Under Contract) to the number of homes Sold. It determines how many months it would take to sell through the current listing inventory. Most economists consider 6.0 months to be a balanced market.

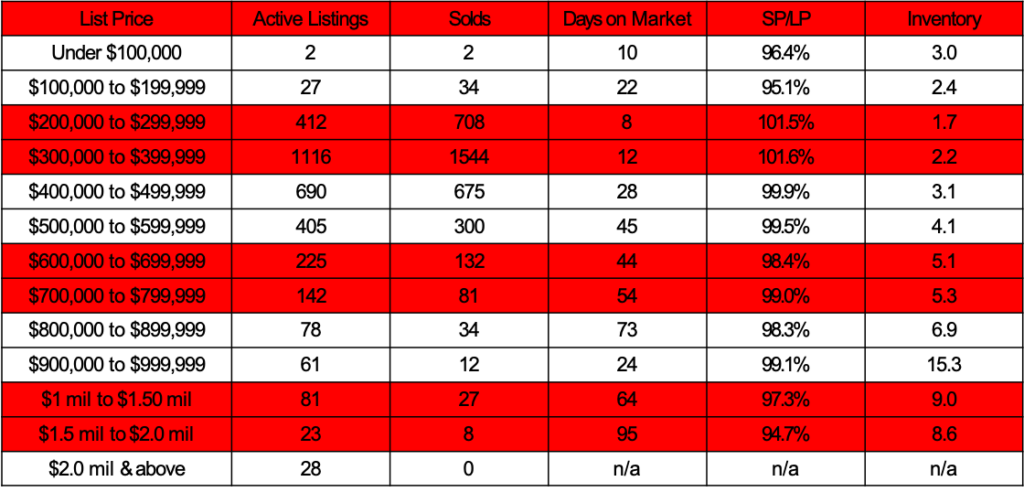

Determine how your price range is performing.

Price Range Comparisons Single Family & Patio Homes

This chart is ideal for helping you determine how your neighborhood is doing. If you are considering selling your home, this information is just one tool you can reference to assist you with pricing your home strategically. If you have questions on how to properly use this data, call me.

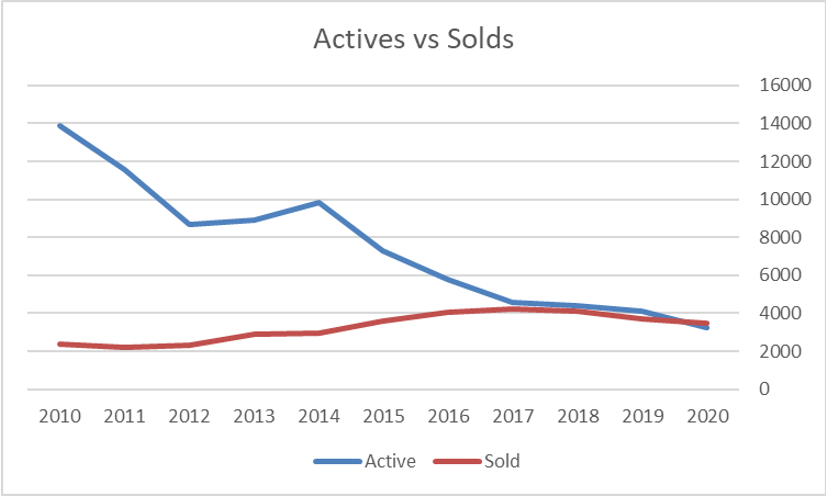

This graph shows the interaction between supply (active listings) and demand (sold listings). A large spread indicates a Buyer’s Market and where the lines get close indicates a Seller’s Market.

QUARTERLY DATA

Average Monthly Active Listings for the Quarter compared to the same period the previous 10 years.

This graph shows the total number of Solds for the period. Comparing this data over the past 10 years helps determine what trends are occurring.

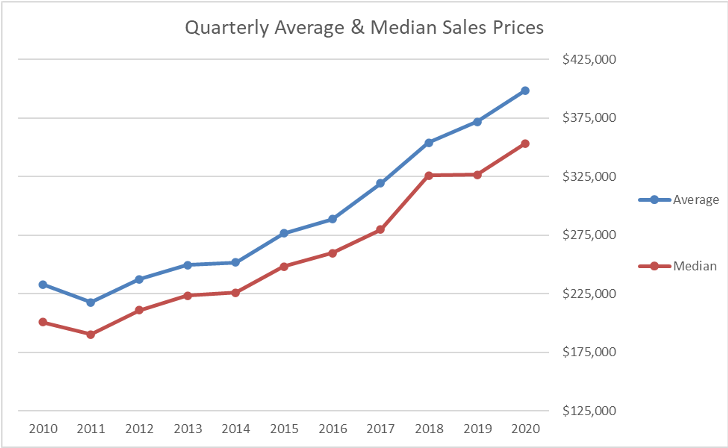

The Average & Median Sales Prices for the same period over the past 10 years. This graph easily illustrates the current health of the local real estate market.

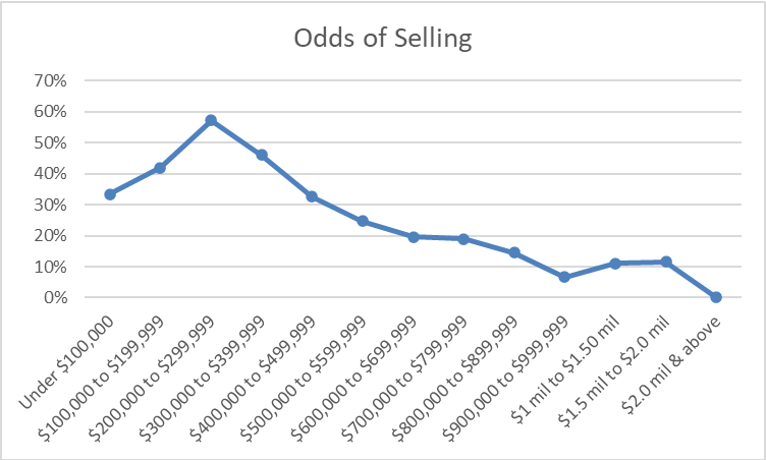

The price range your home is within dictates your odds of selling in the next 30 days. Generally the lower your price, the more potential buyers.

Summary

We hope you and your family are staying healthy during these difficult times. Despite all the uncertainty around the Coronavirus, the local real estate market exceeded our expectations during the 2nd Quarter. We predicted in early April that the shutdown and layoffs due to the pandemic would likely move our extreme seller’s market to a seller’s market. The reality is, we saw the exact opposite during the 2nd Quarter—the extreme seller’s market is even more extreme.

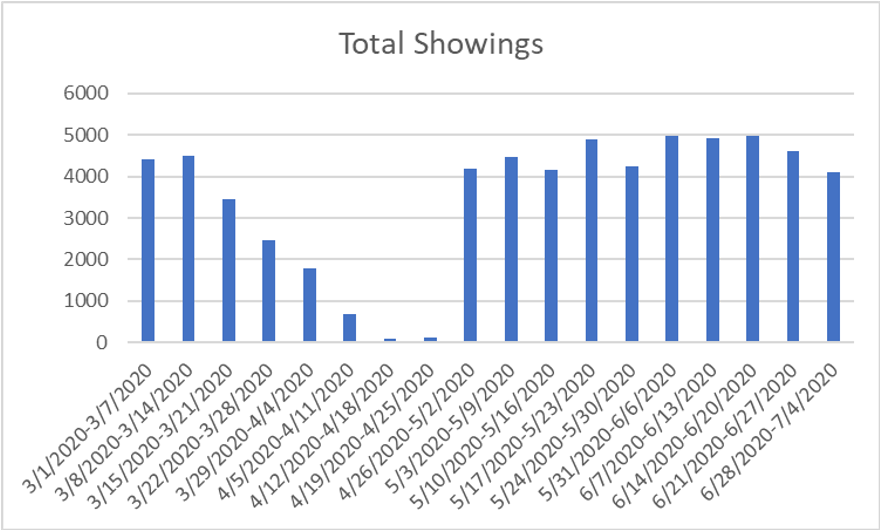

When you look at the decline of showings in April to almost zero (see graph below), you would expect to see sales decline 30-60 days later. During April, we actually saw some buyers make offers on homes after viewing the homes by video only. The drop in sales during the 2nd Quarter had more to do with the continued lack of listings, than COVID-19.

Demand continues to be very strong as Colorado Springs remains as a place where current residents want to stay as well as a destination for those wanting to enjoy our quality of life. Also contributing to the overwhelming demand are record low mortgage rates once again.

Inventory levels for the 2nd Quarter were the lowest on record. In fact, for the first time on record there were actually more sales than there are listings on the market for any Quarter. This unusual phenomenon means sales prices are jumping and we will likely see double digit increases for the year.

The outlook for the remainder of 2020 for our local real estate market is that it will be a record setter in terms of price and low inventory. The real question continues to be how will COVID-19 affect our global, national and local economies. The Colorado Springs real estate market is in a very solid position to withstand any economic downturn. This is due to the continued migration of people to the area which will likely be exacerbated with the build-up of the new Space Force at Peterson Air Force Base.

The data found within the ERA Shields Real Estate Stat Pack, Quarterly Residential Review, is based on information from the Pikes Peak REALTOR® Services Corporation (RSC) or its PPMLS. This content is deemed reliable; however RSC, PPMLS and ERA Shields Real Estate do not guarantee its accuracy. Data maintained by RSC does not reflect all real estate activity in the market. Additional sources include the Colorado Springs Business Alliance, El Paso County Assessor, El Paso County.